No need for the belt | MSMEs need a balanced labour reform

“MSMEs don’t need the belt — stop threatening us with it. We need a helping and guiding hand to ease us into the overwhelming world of business compliance,” said a joint statement from two councils under the Fiji Commerce & Employment Federation (FCEF).

Fiji’s small business community — from the tailors in Lautoka to the market vendors in Suva — has issued a clear message to policymakers: fair labour laws must protect workers without breaking the backbone of the economy.

On Monday, the Micro, Small and Medium Enterprise (MSME) Council and the Women Entrepreneurs Business Council (WEBC), both under FCEF, presented their joint position paper to the Parliamentary Standing Committee on Economic Affairs – calling for phased implementation and regular review clauses to ensure fairness and continuous improvement.

Their submission follows FCEF’s presentation last week, reinforcing a unified private-sector call for reform that is modern, evidence-based and fair.

The weight of a one-size-fits-all framework

The councils argue that a one-size-fits-all framework discourages small enterprises from registering formally, undermining the very goal of inclusive economic development.

Under the current system, the Employment Relations Act, Companies Act and related legislation impose the same administrative, record-keeping and HR obligations on a three-person tailoring shop as on a major corporation.

MSMEs make up nearly 80 per cent of registered businesses, contribute 18 per cent to GDP, and employ approximately 60 per cent of Fiji’s workforce.

They play a crucial role in driving inclusive prosperity by fostering economic growth, creating jobs, and empowering diverse communities. Women-owned enterprises account for nearly 19 percent of formal MSMEs in Fiji, and thousands more women operate in the informal sector.

Yet despite their contributions, many MSMEs remain underserved and undercounted. Structural barriers, such as a lack of access to finance, limited business data and informal operating conditions, continue to constrain their growth.

Common legal barriers include:

High compliance costs (registration fees, reporting requirements, audits, HR policies, etc.).

Complex administrative procedures (licensing, tax filing, labour relations processes).

Rigid labour laws that don’t account for informal or micro employment models.

Frequent policy changes or lack of clarity in implementation, which discourages formality.

Many MSMEs operate with limited administrative and financial capacity, making full compliance with complex statutory obligations challenging.

A tiered, proportional compliance model would allow smaller businesses to meet their obligations effectively while maintaining substantive worker protections.

While laws aim to protect workers, ensure fairness and promote stability, if they are not tiered or proportionate, they can suppress small business formalisation and scaling.

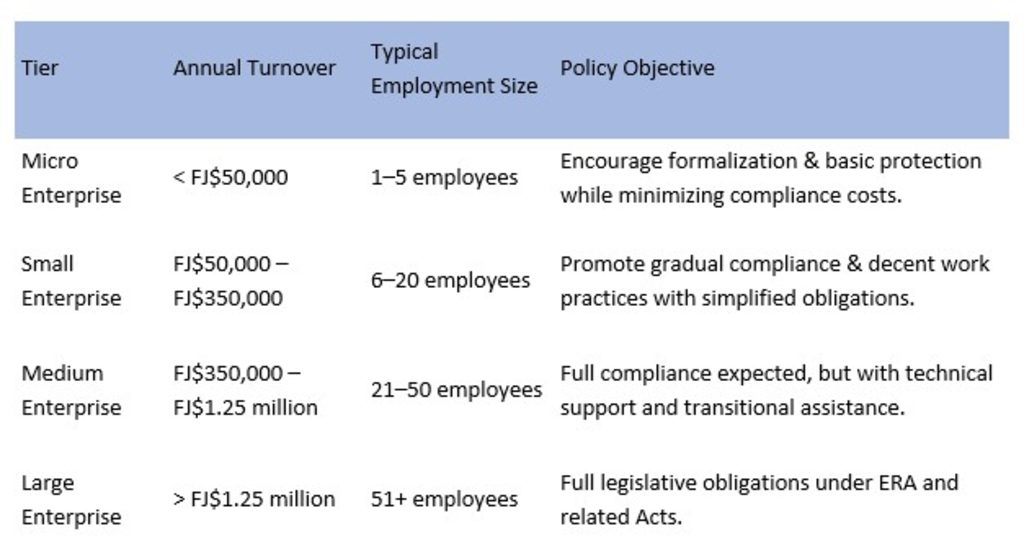

The Council recommends a tiered compliance approach aligned with the MSME Fiji Policy Framework defined thresholds:

Category/Annual Turnover(FJD)

Micro : ≤ 50,000

Small: 50,001 – 300,000

Medium: 300,001 – 1,250,000

This approach ensures obligations are proportionate to business size and capacity while maintaining core protection for employees. All employees, regardless of enterprise size, should retain full substantive rights — including minimum wage, leave entitlements and protection from unfair dismissal.

Proposed scaling of obligations:

Fiji already applies proportional obligations and incentives in the Companies Act 2015, H&S At Work Act 1996 and Income Tax Act 2015 which sets a precedent for a tiered approach under the Employment Relations Act 2007.

Five key recommendations

The MSME and WEBC Councils fully endorsed the broader FCEF position and presented five additional key recommendations:

n Tiered MSME Compliance Schedule — obligations should be proportionate to business size and turnover. This approach keeps core worker protections intact while easing reporting and administrative burdens for small enterprises.

n Establish an MSME Employment Relations Helpdesk within the Ministry of Employment — The Helpdesk should host quarterly capacity building trainings on the law for MSMEs FOC (FRCS MSME Unit is a good example to follow) and also develop an MSME Guide to the ERA complete with simple templates to follow.

n Incorporate a Legal Definition of MSMEs into the Employment Relations Act 2007 to ensure that compliance obligations are correctly scaled.

n Create Incentives for MSME Formalisation, such as concessional finance and tax relief models inspired by India’s Interest Subvention Scheme for registered MSMEs

n Implement a Phased Rollout and Review Clause — allowing time for smaller firms to adapt, while mandating periodic review of thresholds and impacts.

Unintended consequences

The councils also cautioned that several provisions in the current draft Bill could have unintended consequences, particularly for women and small employers.

Extended Maternity and New Menstrual Leave Entitlements — While well-intentioned, these provisions risk discouraging the hiring of women and impose unsustainable costs, especially in micro and small enterprises where workforce numbers are limited. Without corresponding government support mechanisms, employers may perceive female employees as higher-cost hires, undermining gender equity in practice.

Criminalisation of Contract Breaches — The Bill’s proposal to impose criminal penalties for contract breaches that are traditionally civil matters was described as “a dangerous overreach.” The councils argue that employment disputes should be resolved through the existing Employment Grievance Process, not through criminal courts.

Introduction of Form 9 and Expanded Labour Powers — The councils warned that enabling labour officers to fast-track cases directly to court and granting broad powers of entry, inspection, and seizure without warrants opens the door to misuse and corruption. Such measures, they say, risk eroding business confidence and damaging Fiji’s investment climate.

The issue with reforms made in isolation

Both councils stressed that labour reform cannot be pursued in isolation. Fiji’s National Development Plan envisions a transition to a high-income economy by 2047, underpinned by 3.2 per cent annual productivity growth. Yet, national productivity growth remains at 1.2 per cent, well below target.

FCEF’s earlier submission underscored the same point: increased compliance and rising labour costs without productivity gains could slow private-sector growth, raise unemployment and drive informality

The MSME and WEBC Councils reaffirmed their willingness to partner with Government to co-design practical reforms. They urged policymakers to seize this moment to modernise Fiji’s employment laws in a way that empowers both workers and businesses

If the Bill proceeds without amendment, employers warn that cumulative compliance costs — including extended leave, increased penalties, and new reporting requirements — could raise the cost of doing business significantly, squeezing margins and slowing job creation.

Their message is clear: good labour law must protect workers and enable employers to thrive.

Fiji’s economic resilience depends on both sides of that equation.

To read the full story, please click the link